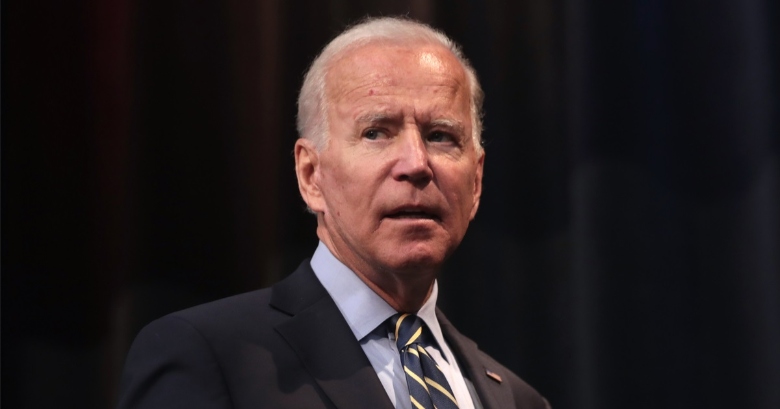

In a dramatic final act as president, Joe Biden has blocked the $14.9 billion sale of U.S. Steel to Japan’s Nippon Steel Corporation, citing national security concerns and a commitment to preserving American industry. The decision, announced on January 3, 2025, has ignited fierce criticism and speculation about political motivations, economic ramifications, and potential legal battles that could shape future foreign investments in the U.S.

Top Immunity Support For The Times:

Immune systems can be weakened by poor diet, lack of sleep, and countless other environmental factors.

Our products may help support your body’s natural defenses.

Save 15% W/ Code “SAVE”

Visit: https://GetZStack.Com

Includes FREE SHIPPING in USA

Nippon Steel, one of the world’s largest steelmakers, had proposed a lucrative acquisition of U.S. Steel, an iconic American company employing thousands. The deal included significant commitments aimed at modernization and worker retention.

According to Fox Business, Nippon pledged to invest $2.7 billion into U.S. Steel’s Mon Valley Works and Gary Works facilities, promising to upgrade outdated infrastructure and enhance competitiveness. Additionally, Nippon assured that U.S. Steel’s name, brand, and headquarters would remain intact, and no layoffs would occur until at least 2026.

Initially announced in December 2023, the proposal appeared poised to boost U.S. Steel’s global standing. However, resistance quickly emerged from both political leaders and union representatives, casting doubt on the transaction’s viability.

From the outset, the Nippon-U.S. Steel deal faced backlash from bipartisan lawmakers and the United Steelworkers union, which represents many of U.S. Steel’s employees.

Critics characterized the sale as a troubling instance of foreign ownership threatening American autonomy. The union claimed it had been blindsided by the merger proposal and expressed skepticism about Nippon’s willingness to honor existing labor agreements and pensions.

Additionally, vague national security concerns were raised. While specific risks were not publicly disclosed, some warned that foreign ownership of a strategic industry like steel could undermine the U.S. defense sector and critical infrastructure.

Biden took a definitive stance, announcing his decision to block the sale in a detailed statement.

“It is my solemn responsibility as President to ensure that America has a strong, domestically owned and operated steel industry,” Biden stated. “Blocking foreign ownership of this vital American company fulfills that responsibility and protects our national strength at home and abroad.”

Biden’s decision appeared to align with his administration’s broader agenda to prioritize American workers and industries over foreign interests.

The announcement triggered a sharp drop in U.S. Steel’s stock price, reflecting market uncertainty about the company’s prospects without Nippon’s proposed investments.

Nippon Steel, meanwhile, responded with a blistering statement accusing the Biden administration of political interference.

“Instead of abiding by the law, the process was manipulated to advance President Biden’s political agenda,” Nippon alleged. “The President’s statement and order fail to present credible evidence of a national security issue, making it clear this was a political decision.”

Legal experts anticipate that Nippon may file a lawsuit challenging Biden’s decision, although no official legal action has been announced yet.

The move has sparked intense debate. Supporters argue that Biden’s intervention was a necessary step to safeguard a critical domestic industry and prevent foreign control of essential resources.

“America’s steel industry is too important to be sold off to the highest bidder,” one lawmaker commented. “This decision protects not just jobs but our national security.”

Opponents, however, view the block as an overreach fueled by political motives rather than legitimate national concerns. Critics argue that Nippon’s commitments to modernization and job preservation demonstrated good faith and could have significantly benefited the struggling steel sector.

“This is protectionism masquerading as patriotism,” an economic analyst suggested. “The administration’s decision risks deterring foreign investment and stifling innovation.”

Should Nippon pursue legal action, the case could hinge on whether the administration can substantiate its national security claims. Experts suggest that the Biden administration will need to provide concrete evidence of specific risks posed by the acquisition to justify its intervention.

If the courts rule against Biden, the case could establish a precedent that limits presidential authority over foreign investments.

This decision caps a presidency marked by tensions over trade, globalization, and domestic economic policy. While Biden has emphasized the importance of protecting American jobs, critics contend that his administration’s protectionist tendencies could alienate allies and deter foreign investment.

For U.S. Steel, the blocked sale leaves the company in a precarious position. Without Nippon’s pledged modernization funds, U.S. Steel faces significant challenges in competing with global rivals, particularly as the steel industry undergoes rapid transformation.

Biden’s move to block Nippon Steel’s $14.9 billion acquisition of U.S. Steel underscores his administration’s commitment to preserving American control over critical industries. However, it also invites scrutiny over the balance between protecting national interests and fostering economic growth.

As Nippon weighs its legal options and U.S. Steel grapples with its uncertain future, Biden’s decision is sure to be debated as both a bold defense of domestic industry and a potentially costly misstep. The story, much like the steel it revolves around, is far from forged into finality.

Easy answer.Because Biden Crime LLC is evil to the core