The General Services Administration (GSA) is taking a significant step by deciding to sell or lease unused government buildings. This move aims to “rightsize its portfolio,” ultimately saving taxpayer money and enhancing government efficiency. Former GSA head Emily Murphy, who served under the Trump administration, has voiced her insights on these changes.

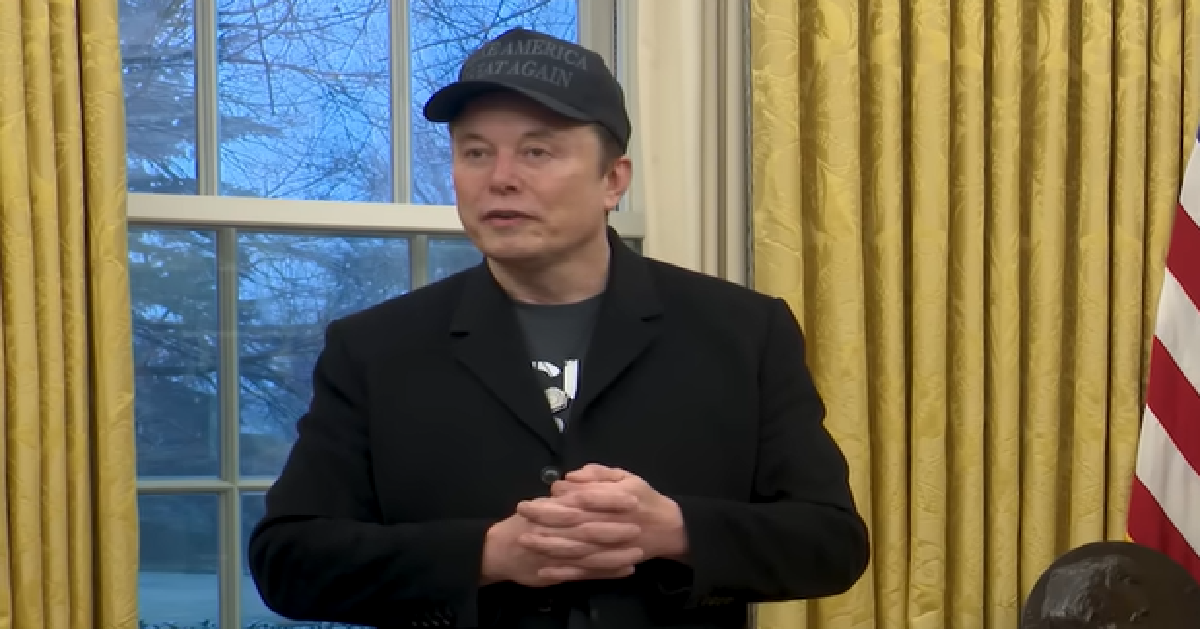

Emily Murphy’s experience in government operations provides her with a unique perspective on the current situation. She has highlighted the potential for the GSA to save substantial funds through this strategic downsizing. According to Murphy, this initiative aligns with efforts by Elon Musk’s Department of Government Efficiency (DOGE) to eliminate government waste.

Murphy pointed out the financial challenges the GSA currently faces. She emphasized that the federal buildings owned by the GSA have accumulated over $370 billion in deferred maintenance. This backlog represents a growing liability due to neglected upkeep.

By disposing of these neglected and unoccupied properties, the government can alleviate this fiscal burden. Murphy believes that removing these liabilities from federal books is a smart move. It not only benefits the government but also presents opportunities for local communities.

The former official explained the potential impact on cities and states where these buildings are located. Unoccupied buildings are detrimental to urban areas, she noted. Selling or leasing them can create new possibilities within these communities.

Murphy highlighted the strategic locations of many of these properties. Often situated in downtown areas, these buildings are in “heavy utilization areas” and have the potential to become valuable assets. Properly utilized, they could significantly contribute to local development.

Selling these properties could also funnel additional funds back into the Treasury Department. The private sector might find these locations appealing, further enhancing economic growth. Murphy stressed the need for the GSA to rightsize its lease portfolio to prevent unnecessary rent expenses.

The GSA has already terminated around 794 leases as part of its cost-cutting measures. These efforts have resulted in the cancellation of over $500 million in lease obligations. Murphy emphasized that taxpayers should not bear the burden of unused government spaces.

The financial impact of this initiative is substantial. Murphy pointed out the billions spent annually by the federal government on rent and real estate payments. By taking decisive action, the GSA can significantly reduce its long-term financial commitments.

Murphy’s comments underscore the potential benefits of this strategy. She believes it presents a real opportunity for the GSA to demonstrate fiscal responsibility. The move could free up funds for other agencies, benefiting the American people in the short term.

Overall, the GSA’s decision to offload unused properties is a step in the right direction. Murphy’s insights highlight the importance of efficient government operations. As these changes unfold, the potential for positive economic impact becomes increasingly evident.

The focus remains on reducing waste and maximizing the utility of government resources. By addressing neglected properties, the GSA can set a new standard for fiscal management. Murphy’s perspective sheds light on the potential for meaningful change.

The GSA’s actions reflect a commitment to prudent financial stewardship. By leveraging its assets wisely, the agency can better serve the American public. Murphy’s remarks capture the essence of this transformative initiative.

As these developments continue, the emphasis on efficiency and cost-saving remains paramount. The GSA’s approach serves as a model for government agencies nationwide. Through strategic management, the agency aims to deliver tangible benefits to taxpayers.

In the end, the GSA’s efforts align with broader goals of government reform. As Murphy articulates, the potential for positive change is immense. This initiative underscores the importance of responsible governance and fiscal prudence.