The national debt of the United States has reached catastrophic levels, with a shocking $473 billion increase over the past three weeks alone. To grasp the severity of this crisis, one could compare it to a financial disaster on the scale of a Mongol invasion—devastating, far-reaching, and seemingly impossible to recover from.

As the U.S. government continues its uncontrolled spending spree, the nation finds itself facing an economic disaster from which recovery may no longer be possible. Some have tried to downplay the danger by comparing today’s debt to the post-World War II era, when the national debt was also alarmingly high as a percentage of the country’s gross domestic product (GDP). However, the conditions today are vastly different.

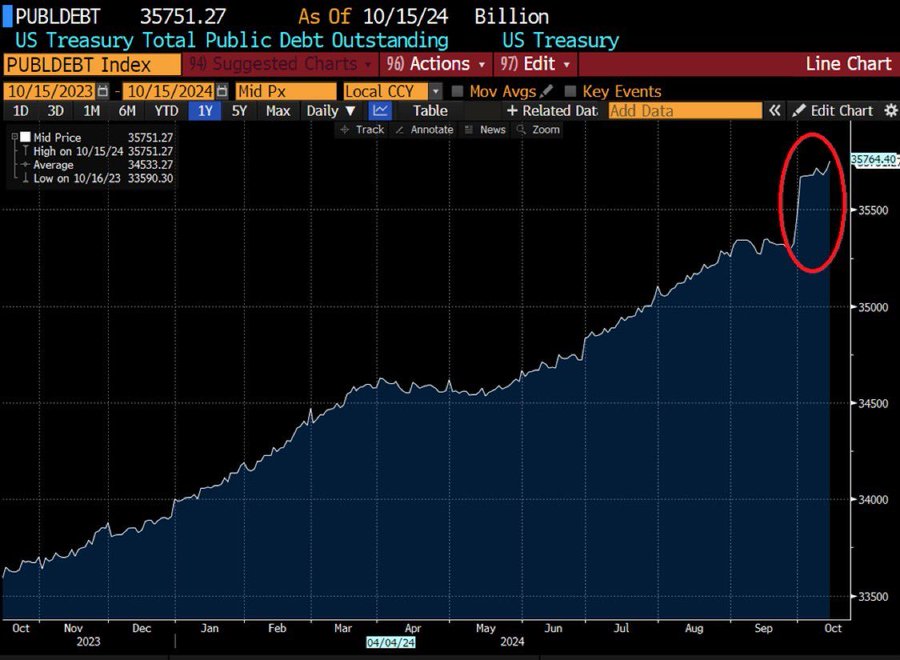

You can't make this up:

Total US debt has jumped by $473 BILLION over the last 3 weeks alone, to a record $35.8 trillion.

This means the US has taken on $1,450 of debt for EVERY American over the last 3 weeks alone.

It also means that the US now holds a record $103,700 of debt… pic.twitter.com/0ocgYe56A5

— The Kobeissi Letter (@KobeissiLetter) October 21, 2024

In 1946, the U.S. emerged from World War II as the world’s only intact industrial power. The economies of Europe and Asia were in ruins, with many cities reduced to rubble, allowing the U.S. to capitalize on its manufacturing dominance. This unique situation helped the nation grow and eventually manage its wartime debt. Fast forward to 2024, and the U.S. can no longer rely on such favorable global circumstances. Today, America faces competition from several global economic powers, and there are no easy paths to debt reduction.

The current $33 trillion national debt has far-reaching implications for every American. It is a financial burden that amounts to six figures of debt for every U.S. citizen, including men, women, children, and even non-binary individuals. Every person in the country essentially “owns” a piece of this colossal debt. But the consequences go far beyond personal liability—it affects the economy on every level, from Wall Street to Main Street.

The ever-increasing national debt isn’t just a number on a government ledger. It has real and severe implications for the broader economy. As government borrowing continues to skyrocket, the cost of debt also rises, which affects interest rates, business investment, and consumer spending. The debt is already contributing to stock market volatility, and many fear it could destabilize the entire financial system if not brought under control.

There are only a few potential solutions to the national debt crisis, but none of them are particularly appealing or easy to implement. The first, and least likely option, is to repudiate the debt altogether—effectively defaulting. However, this would cause massive global economic turmoil, likely leading to a worldwide financial meltdown.

Another option is to inflate our way out of the debt by printing more money, but this would require hyperinflation on a scale seen in places like the Weimar Republic or Zimbabwe. The result would be the destruction of the U.S. dollar’s value and widespread economic hardship for ordinary Americans.

The third option, and the one with the most long-term potential, is to grow our way out of the debt. But that would require the federal government to adopt aggressive pro-growth policies—something that many in Washington seem unwilling to do.

None of these solutions, however, will be effective unless Congress puts an end to the runaway spending that is driving the nation deeper into debt. Senator Rand Paul recently highlighted this issue during a speech in the Senate, where he likened Congress to “drunken sailors” for their reckless fiscal behavior. The senator noted that the federal government is on track to spend $6 trillion this fiscal year while bringing in only $4 trillion in revenue.

However, as Paul pointed out, drunken sailors at least spend their own money. Congress, on the other hand, is spending taxpayer money—or worse, money borrowed in the name of the American people.

Sen. Rand Paul on Federal Spending

A few weeks ago, @RandPaul spoke about Congress, stating, 'Congress spends like drunken sailors.'

Congress is projected to spend over $6 trillion this year, leading to a $2 trillion deficit.

What are your thoughts on federal spending? pic.twitter.com/YkTYv4eJye

— Reef Insights (@ReefInsights) October 14, 2024

Much of this reckless spending is rooted in cultural and political forces that favor big government and anti-growth policies. Politicians, including Vice President Kamala Harris, have pushed for increased government intervention and spending in areas that stifle economic growth. An old saying attributed to Confucius sums up the current predicament: “In a nation with good governance, poverty is shameful. In a nation with bad governance, wealth is shameful.”

This sentiment seems to ring true in today’s America, where policies that reward dependency on government are favored over those that promote wealth creation and economic growth.

To address the debt crisis, the federal government must take drastic steps to stop the bleeding. This doesn’t mean minor cuts or slowing down the rate of spending increases—it requires sweeping reforms. Politicians must be willing to make deep, meaningful cuts to federal spending and eliminate entire government agencies that serve no essential constitutional function.

Agencies like the Environmental Protection Agency (EPA), Department of Education, Department of Energy, and Department of Labor, among others, must be downsized or dismantled entirely. The federal government should return to a more limited role, focusing on the core functions that it is constitutionally mandated to perform.

The IRS, for instance, has grown into an all-powerful bureaucracy that stifles economic growth with its complex and burdensome tax code. Eliminating or radically reforming the agency could free up resources for Americans to invest, save, and grow the economy.

The national debt crisis is not something that can be ignored or wished away. It requires immediate, bold action to prevent a full-scale economic disaster. The solutions are tough, and the road ahead will be difficult, but the alternative—fiscal collapse—is far worse. Unless politicians in Washington wake up and take action, America’s economic future will remain in grave jeopardy.

The Democrats are paying off everybody they need to stay quiet in case of election loss.We are living in a mega criminal jail.